Electronic Filing (eFile) is the most popular method of filing taxes, developed by the IRS nearly four decades ago in 1986. Over One Hundred Million personal income taxes are filed this way each year. Electronic Filing involves formatting the data required on a tax return return into an electronic format and then transmitting it to the IRS and certain states via a secure, encrypted Internet connection. Beginning with the 2011 Tax Filing season, the IRS adopted Modernized eFile (MeF) as the filing method of choice for personal income tax eFilings and filetaxes.online currently uses this filing method. If you eFile your taxes using our system, the IRS and/or state tax authority will acknowledge its receipt and indicate if your return was accepted or rejected. Whatever the result, you will be notified immediately via email, with more detail on the steps to take contained within the account you create with our system.

Online eFiling consists primarily of four parts:

Prior to transmission, your return is subjected to stringent error checks. Once transmitted, the Service Center performs a more extensive error check, resulting in returns with significantly less error rates.

As a result of this efficiency, coupled with the new IRS customer account infrastructure (CADE 2), the time it takes to issue your refund is reduced. If you are able to receive your refund electronically, you may receive your refund sooner than you thought.

If you owe taxes, you will be pleased with the convenience of our I-PAYbyCreditCard payment option to pay off the Balance Due amount. Payment via paper voucher will also be available to print and mail. Tax payments need to be made on or before the due date of the return, normally April 15th, even when you eFile. Electronic Funds Withdrawal or ACH Debit is another payment option available through our system.

As opposed to waiting for snail mail, electronically filed returns are acknowledged by the IRS and if accepted, the returns will be identifiable with a Submission ID. Additionally, filetaxes.online provides an electronic postmark (ePostmark) for all the returns filed. This postmark will have the same effect and validity to the IRS as the postmark affixed at the post office, and as an added advantage, will be correlated with the eFiled return. This level of certainly simply does not exist when you file your tax return via snail mail.

Our service is driven by a simple interview method which will be presented with a sequence of questions that change dynamically, depending upon your specific tax situation. Our “tax robot” processes your input, and computes the data and calculations required by the tax authorities. It is important that you complete the entire sequence in order to ensure that you receive the highest and most accurate refund (if applicable).

At the end of each section, you will be asked if you need to submit more data on another similar form. For example, if you have three W-2s, click the “SAVE & ADD NEW” button at the bottom of the form for each additional W-2 you may have. As an example, two of the W-2 forms may be yours and the other may belong to your spouse if married filing jointly.

If you chose a form input page that you do not need, you can click on the “DELETE FORM” button at the bottom of the input page. If you made a mistake on the form, click the ”IGNORE MY CHANGES” button at the bottom of that input page.

Yes. The IRS and states allow for your personal income tax refunds to be sent by direct deposit to your bank at no additional charge. The IRS states that Direct Deposit is the fastest way to receive refunds from the IRS.

You will need the following information to request Direct Deposit;

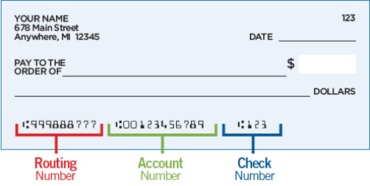

Your Bank’s Routing Number

Do not use a deposit slip to obtain the number, but rather, a rely on a check, or when in doubt, contact your banking institution.

Your Bank Account Number

An indication of whether it is a savings or checking account.

[Grab the image of the check on this page and include as an image to better explain: https://www.mecu.com/Checking-Savings/Checking-Overview/Checking-FAQs?item=questions-121725

What to do if you enter an incorrect routing or account number:

If you filed a return with an incorrect routing or account number you must wait until the return is accepted or rejected by the Government prior to submitting a change.

Other notes on Direct Deposit:

Once we receive the acknowledgment of your eFiled returns’ acceptance from the Government, we are given no further information about the refund or payment process. filetaxes.online is a tax software provider and does not act as your tax preparer. For your own protection, the tax agencies will not share information about your return with us and accordingly, we will not be able to answer any questions pertaining to the delivery timeframe of your refund.

The IRS suggests that you track the status of your refund through the Where’s My Refund application directly from the www.irs.gov website. Please note that it may take up to 72 hours to post your return information after it has been accepted. If you have not received your refund three weeks after the date of your acknowledgment, or if you have any other return related questions, you may contact the IRS, toll free at: 1-800-829-1040.

If there are paper attachments that need to be submitted as part of the eFiled return, you must mail the Form 8453 to the IRS. If you indicated that you will include paper documents in your filing, Form 8453 will be available to print if you log in to your account and select to Print Completed Forms.

If your return is REJECTED, we will let you know immediately via email to login to your client center for additional details. Part of what we will communicate to you is;

Most of the rejects occur due to errors in Social Security Numbers (SSNs), birth dates or Employer ID Numbers. Please check any and all information submitted into our software very carefully. Also, note that if there has been a name change (such as by marriage) that was not reported to the Social Security Administration, these returns will reject.

Through I-PAYbyCreditCard, we are able to provide you with an integrated, one-stop file and pay program that many have repeatedly asked for over the years. This makes it possible for you to pay your tax liability via credit card, and file your return at the same time.

In the case of taxes owed, we will prompt you to choose your method of payment before you submit. When you select the I-PAYbyCreditCard credit card option, you will be asked to provide your credit card information as you do in other instances where you make an online transaction. Your credit card will be used for two separate purposes. Using this service carries with it an additional convenience fee, equal to 3.93% of the tax payment you are submitting.

Your credit card statement will reflect the convenience fee payment and the tax payment charges as “PAYMENT CONVENIENCE FEE” and “US TREASURY TAX PAYMENT”, respectively.

Once the authorizations are obtained, and you make a payment for our other service fees, and direct us to eFile your return, we will do so. When your return is accepted we will settle the authorized charge. If the return is rejected, then, the cause of the reject will need to be cured, and then the return needs to be resubmitted. If the time it takes to cure the reject and to successfully re-submit the return is 7 calendar days or less, the original authorization will be considered valid. Otherwise, per IRS rules, a new, fresh authorization will be required. Due to the fact that the banking system may consider any authorization to be valid for a period of 30 days, the second authorization may create an additional burden on available credit limits, and in the case of debit cards, block the available cash. If such a situation is to occur, it is your responsibility to maintain the required relationship and communication with your card issuing institution so as to maintain proper credit or cash limits with them. The last authorization date will be considered to be the payment date by the IRS.

The fact that you are making a payment by credit card will also be reported to the IRS under your tax ID number (SSN, etc.), with your chosen payment amount. None of your credit card information will be provided to the IRS.

Electronic Funds Withdrawal, or Direct Debit is a way to pay your tax liability directly from your bank account using the Automated Clearing House (ACH) banking network. With this method you can instruct the Government to debit your account for your tax payment at the same time you file your return. Different than other providers, there is no fee imposed by the Government or filetaxes.online for direct debit payments.

When filing a Form 1040 Personal Income Tax Return, Form 4868 Application for Automatic Extension, or a State tax filing with a balance due, as you finalize the tax return filing, the System will ask if you want to pay using a paper check, Credit Card, or Direct Debit. If you select Direct Debit, you will be asked to enter information about your financial institution. The information can be obtained from official financial institution records, account cards, checks or share drafts that contain the taxpayer’s name and address. It is recommended that you check with your financial institution to confirm this information.

You will need the following information to complete the Electronic Funds Withdrawal transaction:

Additional Information:

Cancellation, Errors, and Questions

Once your return is accepted, information pertaining to your payment, such as account information, payment date or amount, cannot be changed. If changes are needed, the only option is to contact the Government agency.In the event your financial institution is unable to process your payment request, you will be responsible for making other payment arrangements, and for any penalties and interest incurred. For federal payment requests, call IRS e-file Payment Services at 1-888-353-4537 to inquire about or cancel a payment, or to report problems such as bank closures, lost or stolen bank account numbers, closed bank accounts, or unauthorized transactions. If calling to inquire about your payment, the IRS recommends that you wait 7 to 10 days after your return was accepted before calling.

Cancellation requests must be received no later than 11:59 PM ET two business days prior to the scheduled payment date.

If a payment is returned by your financial institution (e.g., due to insufficient funds, incorrect account information, closed account, etc.) the IRS will mail a notification letter to the address we have on file for you, explaining why the payment could not be processed, and providing alternate payment options. For questions regarding the letter, please call 1-888-353-4537.

Contact the IRS immediately at 1-800-829-1040 if there is an error in the amount withdrawn. In the event Treasury causes an incorrect amount of funds to be withdrawn from a bank account, Treasury will return any improperly transferred funds. For state payment issues, please contact your state revenue agency.

Filetaxes.online provides an electronic postmark (ePostmark) to each completed and constructed return filed by our system. The ePostmark is based on our system clock, located in the United States, Pacific Time Zone. Taxpayers must adjust the ePostmark to the time zone where they reside to determine the postmark’s actual time.

The receipt of an ePostmark provides filers with confidence that they have filed their return in a timely fashion. The date of the ePostmark is considered to be the date of filing when the date of ePostmark is on or before the prescribed due date, even if the return is received by the IRS after the prescribed due date for filing. This is similar to the postmark generated by the post office for an item mailed.

All requirements pertaining to the signing of the return, timely re-submission of a rejected timely filed return must be adhered to for the ePostmark to be considered as the date of filing. If the ePostmark is after the prescribed deadline for filing, the IRS actual receipt date, not the date of the ePostmark, becomes the filing date.

The ePostmark, tells the tax agencies when the completed, fileable return was perfected and received by us. We consider the return to be received when the return data entry process is completed, the payment of a fee, if applicable, is made, and the filing is submitted for electronic filing by the user.

Once an ePostmark is generated, we retain it as your ePostmark of record. In the event that your return is rejected, the corrected return will be submitted with the same ePostmark for a specified period of time. If however, the time allowed for retransmission of the rejected return is beyond that allowed by the Government due going beyond the date of normal filing deadline, a new ePostmark will be issued and that new ePostmark will be your ePostmark of record in our system. In the latter case, it is presumed that, in the absence of an extension, the filing may be considered to be late and create associated penalties and interest.

Filetaxes.online is a fast, safe, and competitively priced tax submission service. Some of the services we provide are as follows;

Electronic filing (eFile) option – We eFile your taxes electronically as part of our service.

If you choose the Direct Deposit option, your refund will be deposited into your bank account in the quickest method possible. If you have a balance due, you may have your balance due amounts paid through Electronic Funds Withdrawal, or our I-PAYbyCreditCard integrated file and pay product will allow you to make your balance due payment using your credit card as you file your return.

Bank and Financial Institution Products or Refund Settlement Products are offered that will allow the tax return construction fees to be deducted from the refund.

We also process information returns such as W-2s and a whole host of 1099s. These forms are eFiled to Social Security Administration (SSA) and the IRS, respectively. Once your return is accepted, you will be able download copies of your accepted return at no charge to you if the return was prepared for a fee.

We will charge you a fee for the use of our system and services. This fee is payable by Visa, Mastercard, Discover and American Express. You may also allow us to take it out of your refund if you apply for a bank or financial institution product, provided that this option is available in your state or jurisdiction.

You may reach us by emailing us at support@filetaxes.online.

Refund Settlement Products or Bank Products or Financial Institution Products are those that provide additional services to taxpayers to assist in receiving their tax refund. One of the largest benefits is that they offer you the ability to pay our fees from the proceeds of your refund.

Normally, an application received from the customer for these products and this application is passed over to the provider of these products, a financial institution. We are not part of the provider of these products, nor does the provider have any relation to us other than to receive your application for their products through our site and pay us a fee. The use of these products is not mandatory, but is an option if you are claiming at least a certain level of refund. There may be different levels of service available from the provider(s).

These products are currently offered through Refund Advantage, Refundo, River City Bank, and Santa Barbara Tax Products Group (TPG) .

We offer the convenience for you to eFile a completely Paperless Federal return. The IRS made it possible for virtually all qualifying taxpayers to electronically eSign their tax returns by entering a five digit self selected pin number along with a piece of previous year tax data, which is referred to as the “shared secret”. The shared secrets consist of the previous year’s adjusted gross income amounts with a tolerance of +/- $1.00 (One Dollar). For the case of joint filers, the information must be entered for both, even if it is the same information. Our system is designed to provide these items automatically for our clients who have filed through us for the previous year. It should be noted that the information will have to be the same as it appeared in the originally filed and accepted return. If the return was modified and or amended later, the original numbers still are required for this purpose. Also the previous year PINs can be provided as a shared secrets.

WARNING